Blackrock vs. Some Guys in Sweatpants @Starbucks

Tether at the forefront of the crypto conversation

In my second article ever on this Substack, I talked about some myths and misconceptions about asset managers like Blackrock.

Last week I was having lunch with some guys and we got to talking about crypto. The main, exciting, topic was about the announcement of Tether’s income, the issuer of stable coins like USDT or MXNT.

But what is a stablecoin? and what does that have to do with my brother Larry Fink and his business? Well, let’s talk about that.

Stablecoins

I have talked before in some articles about how people think Bitcoin = Crypto, which is not accurate, that Crypto = Ponzi, which is not accurate and that their wealth banker in JPMorgan is THE guy to talk to about why crypto is a scam, but TSLA at a 50 PE is a bargain, also not accurate. Bitcoin = Ponzi?, maybe… probably accurate.

Moreover, ‘not accurate’ is an understatement. In the article below, I go deeper into this and why there are crypto assets that even Warren Buffett himself could not come up with a solid argument against their intrinsic value. (And if he tries it’s because he is old, jeje). What is the actual value number, who knows… but there is undeniable intrinsic value there.

Additionally, I have talked about specific applications for blockchain-based services:

Now, Stablecoins.

Basically, Stablecoins are digital representations of official Fiat currencies. From the US Dollar to the Mexican Peso to the Euro. Companies digitalize the currency so that it can be transacted in smart-contract based blockchains. The idea is that 1 Unit of USD Stablecoin = 1 USD (Virtually). Now, how do they do this? well, i have a very extensive article talking about this:

But let’s explain it in simple terms. We’ll use USDT as an example, which is Tether’s version of a USD stable coin.

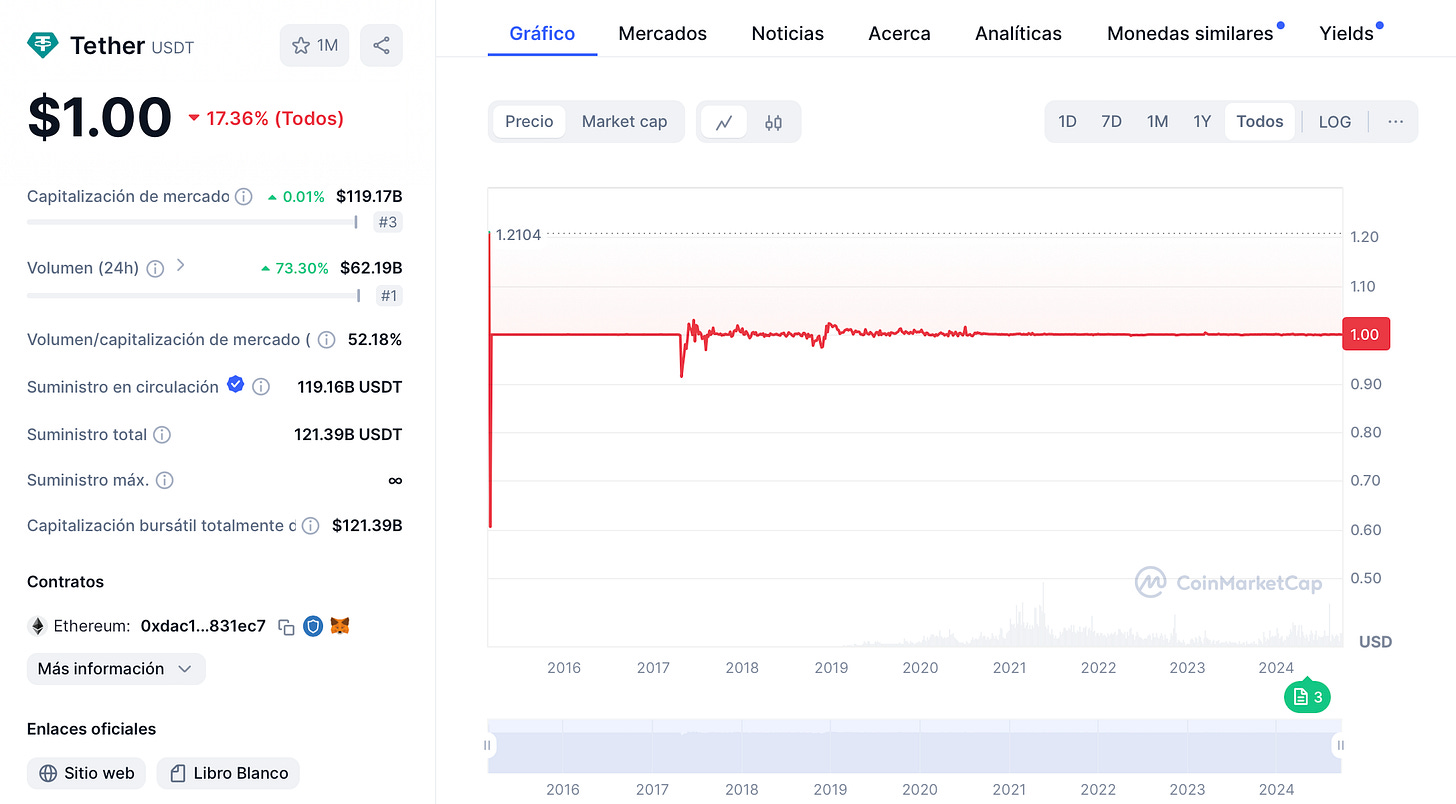

Basically, we need for 1 USDT = 1 USD all of the time. How do we do this? Arbitrage; basically, the issuers set mechanisms for the market to profit from making sure that 1 USDT = 1 USD, no more, no less. Without going too deep into it, here is proof that the mechanism has worked for many years.

A key part of the arbitrage mechanism is that there are USD cash and equivalent reserves in a bank account that provide collateralization (backup) to every USDT issued in the blockchain. Meaning that Tether could, theoretically, replace every USDT it has issued with a USD Wire transfer from a bank that has insurance and is regulated.

There have been questions about Tether’s reserves, but none have proven to be concerning so far for USDT users.

Now, granted, Tether’s banking services are in China, mostly, and other sus jurisdictions. But competitor Cicle is US Based issuer of USDC Stablecoin and has much more solid banking relationships.

Now, back to USDT, when you have of hundreds of thousands of millions of dollars in USD Cash deposits we all know what you have to do with them: Lend it out to the US government.

Tether

So, Tether is a company that issues stablecoins. Legally, it is constituted as this mess of legal entities below. Why is it such a mess? Governments do not like the idea of cash-like transactions made to be easier. Because they go below their radar, some reasons for this are good, others are more shady. The case is that these cyrpto companies have to jump through some legal hurdles in order to maintain operations:

Tether is a small company, just recently trying to expand to 200 people, as a comparison, Blackrock employs 100x this amount at about 20,000. So, Tether is, basically, a startup with as much AUM as a large Private Equity fund. Another comparative point would be KKR, that has, about, twice the AUM of Tether and employs 45 hundred people.

Tether’s workforce usually works from home and, although it is technically complex, it still operates like a small business with help desks, online applications, etc. I know, from personal experience, that the due diligence Tether does to Institutional accounts is very, very, very thorough and strict. And, personally, i’m more comfortable with holding USDC rather than USDT, but anyways.

As I said, Tether has to have collateral 1 USD in collateral in order to issue 1 USDT in the blockchain, without adding up other stablecoins they issue, they have issued $119,162,238,140.34 of USDT as of this moment, the number goes up and down a bit, but the overal trend is that more and more people each year want the opportunity to own blockchain-based digital USD:

Tether Business Model

How does Tether make money? two main ways:

They invest the cash reserves in short term treasuries, bonds and a small part in less liquid and/or safe investments. Because USDT holders don’t demand a yield on their deposits, USDT essentially works as an unregulated bank that does not have to pay interests to their depositors, they keep, virtually, all the proceeds from their investments

Additionally, they charge some transaction fees

Of course, thanks to this, risk is added to the system. Holders of the token are not receiving benefits from the extra yield, the average USDT holder would be much safer with the collateral just being sitting in multiple insured accounts without having the risk of short term treasury price changes or the change in value of other investments. But holders understand this and they still decide to make USDT their stablecoin of choice.

Additionally, there are smart contract risks (someone might hack the contract during a USD→USDT exchange), banking risks (as we saw last year with the Circle/SVB drama), and legal risks. There is always the risk that a bank run could leave the bank insolvent.

Despite this, the asset has worked for many years. It is also 3X the size than its largest competitor, Circle (USDC), even whilst having less solid banking and third party relationships. A great deal of this is because Circle is under a much more hostile environment and constantly under threat by the SEC.

The legitimacy of Tether tokens comes from

Several years of operational efficiency and security

Voluntary reports audited by Italian Auditing, tax, etc. firm BDO. Which is a huge accounting firm, very close to the big 4 accounting firms

So, is Tether a good business? well, Yes, its amazing.

Tether vs. Blackrock

Now, why is the title of this article about Blackrock? In the end, the #1 concern of most businesses is making money. Of course there are elements like value, enjoyment, charity, community, etc. but the first point of concern is profit. Blackrock is constantly refered to by lots of people as en example of a huge and powerfull business. But, if we look at revenue for the first 6 months of 2024, Tether actually enters the stage much harder than most people would expect. Assuming Blackrock is 100X larger in many of the key metrics, we should see Blackrock’s income be higher than Tether’s by several orders of magnitude, right? Well, no. Okay… okay, but at least it should be higher, right? well… let’s look at the numbers that come straight out of the Blackrock investor report and the Tether audited report:

The profits for Tether come from the audited statement of changes in equity because there is no income statement in the audit. Income for Blackrock is Net Income attributable to Blackrock Inc. for the 6 months ended on June 30 2024. The employee figures are approximations. Average AUM = (PeriodBegin+PeriodEnd)/2

So, basically, Tether had 1.6X Blackrock’s income while running an operation that is 100X shorter in employees and AUM. The **Marketcap for Tether is valued at the same PE as Blackrock, while its very true that Tether’s WACC is probably much higher, the growth potential seems huge.

But what is behind these numbers. Blackrock is like a huge factory manufacturer, and USDT acts more as a Retailer and charges incredibly high margins over its AUM, especially given a high interest rate environment. The volume that Blackrock has, its AUM, is huge at about 10T USD, which makes it very systemically key to global economic stability. Giving it a lot more power, but also a lot more responsibility in the form of regulatory oversight. Blackrock is too big to fail, USDT is under constant existential threat. I would not choose USDT as a business over Blackrock, yet. But it does come to show how the dApp space is wildly undervalued in terms of its current value and potential. Blackrock is one in a billion, but making a Tether is much more within the reach of people.

Nonetheless, look at the below handsome boys and see who’s winning (according to google and Forbes). Apparently, Paolo Ardoino, Italian and Tether’s founder and CEO, is more than 3X richer than Larry:

Crazy, right? What I think this shows is that there is a lot of space for innovation growth that is being occupied by overly strict regulatory environments and monopolistic gatekeepers vertically and horizontally integrating every minute of every day. This is a company that is 160 times more efficient in employee-profit ratio than one of the most important companies in the financial sector.

Granted, regulation is needed, and when something becomes too huge, to the point of being systemically important, the fact that individuals accept their own risk is not enough, because the scale of the consequences from a failure start to bleed into all kinds of related places in the system or into other systems. But there must be space for small innovators to test out ideas in small markets where the systemic risk is low and where everybody accepts their individual risk. Think about how biotech, pharmacology, energy production, etc. could improve if regulation was more efficient.

Conclusion

Peter Thiel has talked tirelessly about de-regulation and its role in de-stagnation in human progress. I think that Stablecoins are an example of him being potentially right.

The idea that huge monopolies + over-regulation can slow down progress is very intuitive, monopolies don’t innovate until they have to, over-regulation prevents smaller companies from threatening the hegemony of monopolies by leaving them no margin space to make mistakes while innovating. The world can be better and governments have to find a way to foster innovation while protecting customers from systemic risk. We don’t need more “cooler” features in social media, what we need is to find more efficient ways of producing energy, better medicine, healthier ways to produce more food, better water management, better traffic management, etc. This is something we need to do if we expect to gracefully survive the challenges threatening the world as we know it.