I wrote an article about how the Ethereum Blockchain, and other smart contract blockchains, have multiple uses. Technology is being built on top of them that could very well shape the future of financial market infrastructure, identity verification, election voting, etc. A good example of new technologies is how Decentralised Exchanges work, also called DEXes. Here is a conference I participated on where some of these applications are explained.

General disclaimer: crypto data can be confusing and has to be taken with a grain of salt because there are not yet a lot of standardized measures of things and/or these measures are in constant change.

For simplicity, we can use Uniswap, the most popular one, as an explanatory example of the inner workings of these things.

Decentralized Finance - DeFi

Decentralized Finance or DeFi is a new, experimental, financial infrastructure that is built on top of Smart Contract Blockchains. The main idea is to create infrastructure for a financial market that is decentralized, meaning that no individual agent, company, government, etc. has discretionary control over them. Instead, the community of users of the infrastructure, who have an interest on making the service cheaper and better, are the ones who pseudonymously vote on the changes made to it and, lately, receive distributions over earnings. Also it aims to be transparent, pseudonymous, permissionless and everything good that is inherent to public blockchains. This infrastructure manifests as dApps or Decentralized Applications.

These dApps are required to have some fundamentals (not so strict and oversimplified), as established by cryptocurrency theorists:

The dApp’s code has to be open source and accesible to everyone, at least in its majority and most important elements

It has to be built on top of a Public Blockchain like Ethereum, Solana, etc.

The dApps tend to have a “Governance Token” that gives equitable rights of voting on changes to the dApp to the holders, proportionally to the size of their holdings. Really similar to stocks in Traditional Finance

The Governance Token has to be distributed amongst users/contributors to the dApp in proportion to their contributions to making the infrastructure better

In general, it is the consensus that DeFi was born in 2017 when MakerDAO created the USD Stablecoin DAI that works in the form of an over-collateralized lending facility that issues the DAI stablecoin.

Essentially, these dApps are algorithms that are programmed to do something very specific. For example, you want BTC and want to exchange it for some ETH, a Smart Contract (a computer program) that is public, along with all of its activities and transactions, has very specific instruction on how to determine how much BTC you get for your ETH.

(For the following statements just add a “Mostly” provision)

Because everything is public there are no hidden fees, no tricks and no secrets. There can be, to this matter, some mistake in the code or vulnerability, but it transparency makes it so that it is much easier to spot and solve. Also, I can “trust” the dApps because I can see what it’s doing and what it is programmed to do at all times. Of course, most people cant understand simple code, and this is very high level programming, but it is a step forward from the secrecy behind proprietary software.

Because the control over decisions to change the code of the computer program is distributed amongst all of the users, who are thousands of people that are pseudonymous and don’t know each other, there is no central decision making over what has to change, making all of the changes that happen more democratic and therefore, in most cases, aligned with what most of the users want to see from the product. And also, funky business admin things are greatly reduced.

Because it’s built on top of a public blockchain, all transactions are public, pseudonymous and immutable, making it almost impossible to retroactively change anything that went on that had already been registered.

Because it is public, anyone can use it, no one in the world can prevent someone from using these services, except from physically preventing them from doing it.

All these lead to a more transparent, democratized, secure and better (in most ways) financial service.

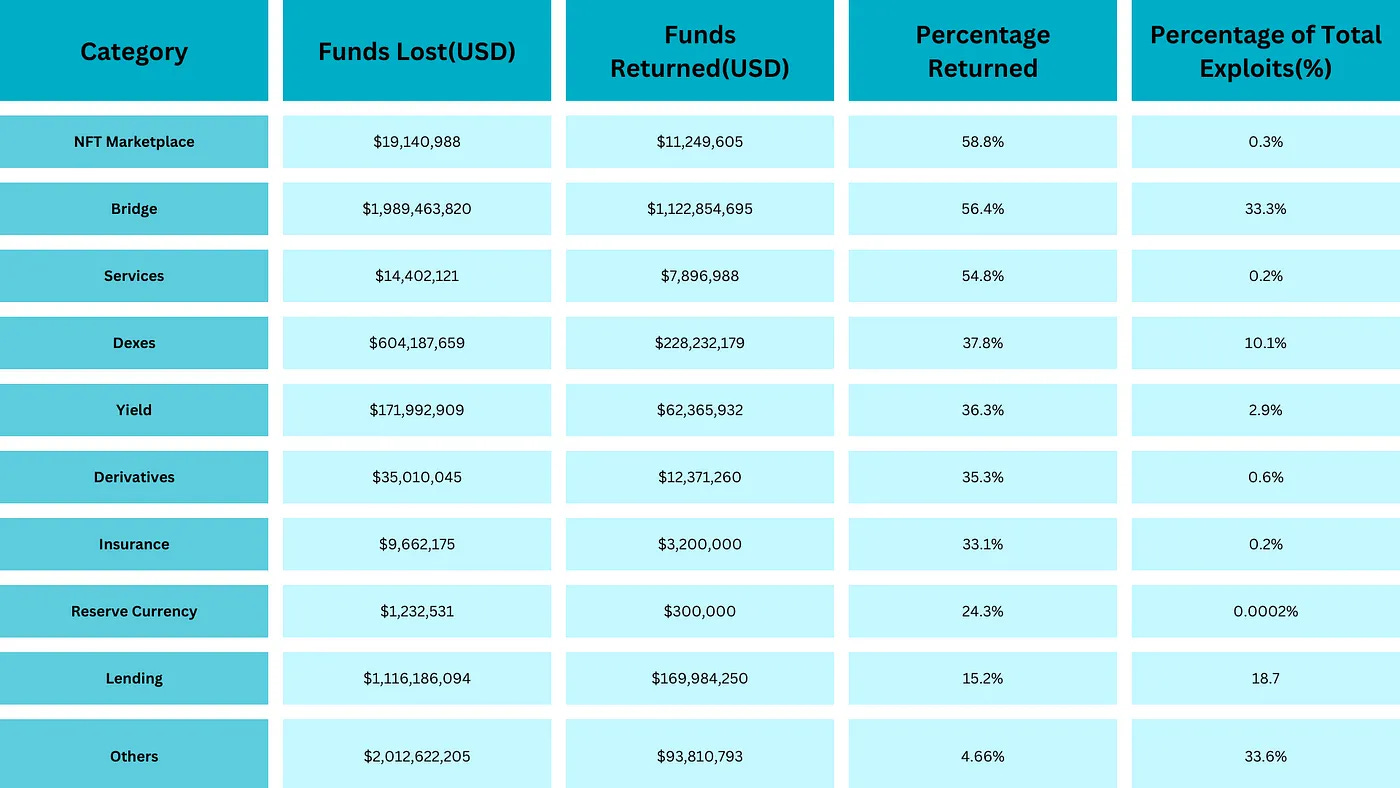

Now, there have been many instances of hacking these dApps where loss of funds was substantial. The total amount of money lost in hacking is estimated at 8.5B USD to date, which has been decreasing from the DeFi Boom in 2021-22. The single largest hack amounted to 624M USD.

This might sound bad, but it’s not that bad (😏). First of all, the average for % of funds stolen being able to be recovered after a hack, across all hacks, could very well be close to the funds recovered from high yield bonds after default in 2020 (it’s hard to know for sure but wouldn’t be surpirising). Additionally, if we compare the funds lost per year to the Madoff scheme, which was regulated by the SEC and other major financial authorities, the losses per year of operation were twice as high for Madoff as for DeFi, even under conservative estimates. With each hack, the infrastructure becomes more secure and achieves better results as the ecosystem learns from it’s mistakes.

A problem that is more complex with DeFi is about DecentralizedGovernance. In general the idea of having no central agent that is responsible for the security or well functioning of something can be problematic. Although much less centralized than stock ownership tokens tend to be held really disproportionately amongst users, creators, etc. which leads to very small owners just being alienated from the voting. Despite this, functioning of this services has been overall better than traditional financial services in many ways and have exposed the difficulties of dealing with the current traditional financial infrastructure.

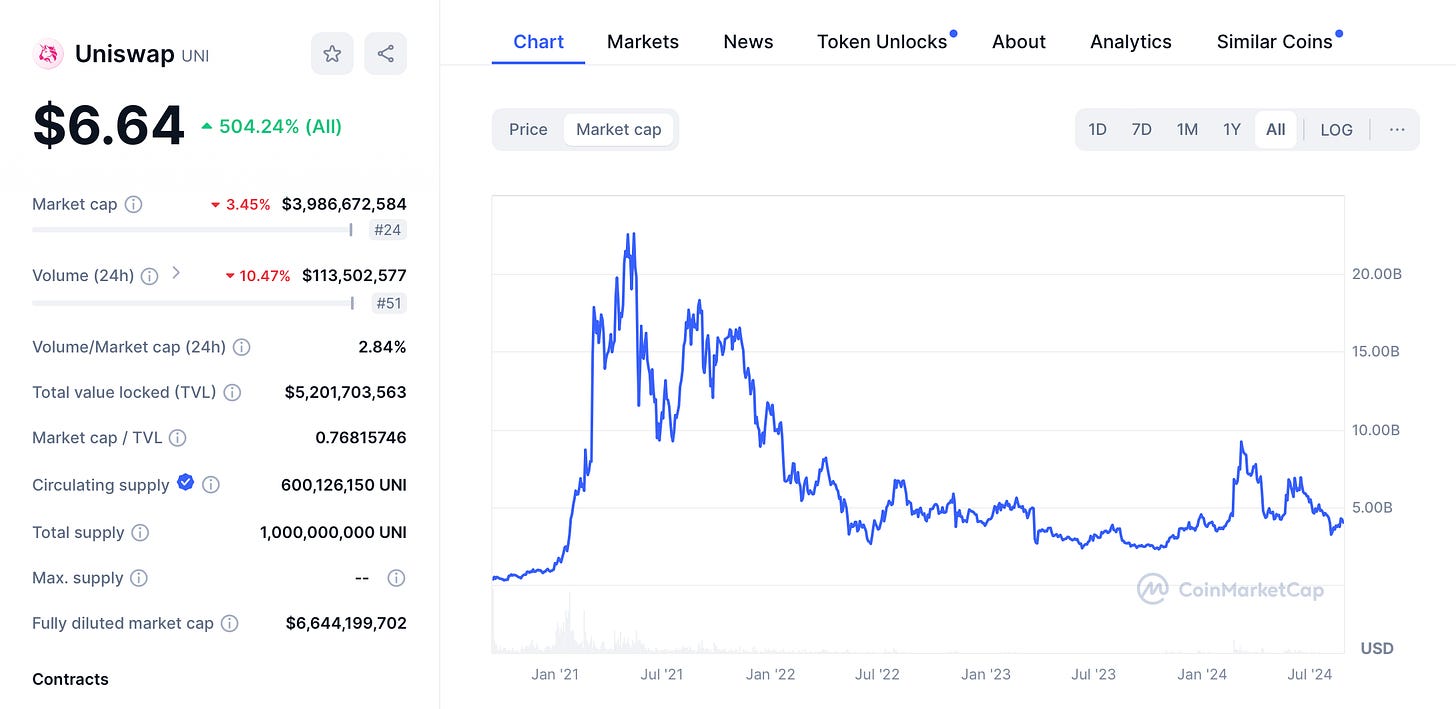

Look at one of the Blue-chip tokens of DeFi, Uniswap.

Uniswap

Uniswap is the largest Decentralized Exchange in the world. It came to light in 2018 and was backed by important VC firms like a16z. Basically, you go into https://app.uniswap.org you connect your crypto wallet and you can trade your assets.

A normal stock exchange usually works by creating markets in which shares of companies, or other financial products, are paired against USD. The market determines how many USD’s is a single share of a company worth through an order book.

An order book is a digital database that is updated on real time where buyers and sellers publish prices at which they would be willing to conduct an immediate purchase/sale of a particular financial instrument. The Stock Broker’s job is to create a legal, technical and overall infrastructure, in partnership with a stock exchange, in which buyers and sellers can do this in the best way possible. There are Decentralized Order Book Exchanges like DYDX (which has the coolest name ever) but most of DeFi works in a different fashion.

Uniswap is different, it doesn’t work with an orderbook, it’s a different type of technology called an Automated Market Maker (AMM). But most exchanges for financial products in the world use orderbooks, why not use orderbooks for this? Well, the main reasons were: 1) liquidity, in the early days of DeFi it was really hard to find lots of buyers/sellers at all times, AMMs try to solve this through an ingenious method. 2) Technical complexity, given that dApps are just computer programs, they must avoid technical complexities as much as they can, an order book involves processing a lot of data in real time and this can be overwhelming for blockchains which purposefully have intricacies with publishing new data which leads us to 3) reduced costs of blockchain activity, being that a blockchain charges for every datapoint you want to publish, transacting through orderbooks became really expensive.

Below is an example of how this works in reality, accompanied by some sane safety tips:

So what is this revolutionary AMM thing? well let’s take a look.

AMMs

Market Makers are a term coined in the financial industry way before Bitcoin was even invented. Originally, Market Makers are people or institutions that are authorized to trade on stock exchanges but they do not earn from stocks going up or down. Their job is to both buy and sell the same shares continually at different prices so that they benefit by the spread of the buy/sale ratio. This benefit is called making a turn on the spread. Now a days Market Makers represent a much more substantial role in modern financial markets, stock exchanges like the NYSE have a Designated Primary Market Maker as a way of assuring clients that there will be allways some liquidity present on the system (someone willing to buy and sell) at current market prices. Fun fact, Bernie Maddoff actually was commended very widely for continuing to provide liquidity to the market during the 1987 stock market crash with his trading firm that was led by his two sons.

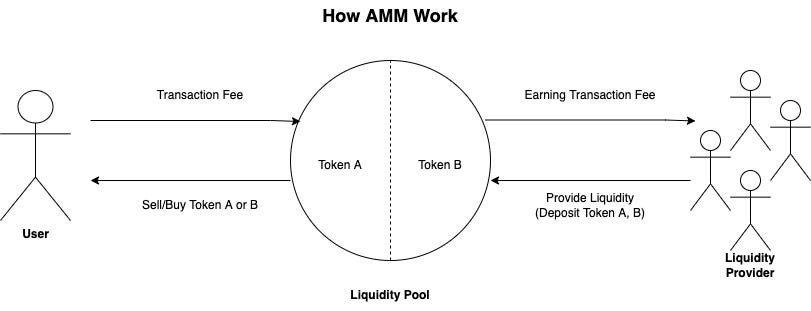

Now, the word Automated is where innovation comes into play, conventional Market Makers are active agents. the AMM adds liquidity to the system in a passive manner. What this is, basically, is a set of rules in the form of a Smart Contract that holds pools of assets. Let’s, for simplicy, say that we only want to exchange ETH for USDT (1 USDT = 1 USD).

So what this technology does is the following: a smart contract has instructions to define an exchange rate between ETH and USDT. The exchange rate is defined by a fixed formula that can come in the form of a linear or hyperbolic function, or a combination of both. Once that the Smart Contract has been programed it is given the ability to custody (hold on to) assets as any other wallet can. Then, we need to get a hold of a large pool of both tokens, USDT and ETH. In order to do this we incentivize people to lend their ETH&USDT to the contract in exchange for interests on lent assets in the from of transaction fees. These lenders are called LP’s or Liquidity Providers. They have to provide both assets in the same proportions as the pool’s holdings in order to provide liquidity in order to no impact the price by liquidity provision. Same when withdrawing.

After there is a pool with both USDT and ETH then people can come in and exchange one for the other. As said, a formula defines the exchange rate, specifically, it is computed by undertanding the relative scarcity of USDT to ETH. If the pool is at equal proportions and someone comes and takes half of ETH, he must leave more USDT/ETH than if he would take only 30% of the ETH, because he is making ETH scarcer relative to USDT. For example, below we have the hyperbolic version of the equation, called the Constant Product function:

Where K is a constant number. This formula is very useful to create infinite liquidity, because K is a constant, whenever ETH is decreased (someone buys ETH) we have to just solve for USDT in order to understand how many USDT must be added to the pool in order to compensate. The more ETH we take the higher the unitary price per ETH the equation will demand. We can see the differential to understand the inverse relationship better:

The % change in one must be compensated by a proportional change in the opposite direction by the other which establishes the exchange rate.

We can see this in real time by asking some quotes from Uniswap. Below we have requests to purchase different amounts of ETH, the higher the amount the more expensive each unit gets.

This is key, because, when proportionality defines price impact, the smaller the pool the more volatile the asset, as the odds of someone making a large enough transaction to wildly change the unitary price is higher. This creates a great Network Effect advantage for big guys like Uniswap, or a positive feedback loop on user acquisition, which can become problematic by creating monopolies or oligopolies, but this sounds really good to Unsiwap’s owners, AKA anyone who wants to buy Uniswap tokens.

Uniswap’s success

Look at some stats by this company. Since its inception in mid-2020, the total transactional volume processed by Uniswap amounts to 2.07 Trillion USD, or $2,070,000,000,000.00, or short of 40B USD per month. For comparison, The entire Mexican Stock exchange has much lower monthly trading volume than Uniswap.

Liquidity Providers receive an average 0.3% fee over transaction volume as compensation for locking their assets in the pools. Some pools might be more or less expensive ranging from 0.05%-1%. Meaning several hundreds of millions in fees has been paid to liquidity providers in exchange for liquidity. This is hard to calculate but it would not be surprising. Additionally, 135,000 ETH have been paid in gas fees that are required to use the service.

Uniswap’s governance token UNI is considered a “blue-chip token” meaning that it is the consensus that it is an important, sustainable and well managed project on the crypto market. As of today, the marketcap of Uniswap is placed at about 4B USD, at its ATH it was worth about 22B, which is 1/6th of Blackrock’s marketcap.

How can we value Uniswap? well, currently Uniswap is not yet charging a service fee but in its documents it is stated that they will be able to turn on a 0.05% out of LP fees at their discretion. Not only that but Uniswap is planning to distribute earnings, if any, amongst UNI holders, from this it follows that we could start having DCF valuations for tokens like UNI and bridging the gap for institutional investors and users to feel more comfortable with owning the token.

Currently, Uniswap’s development is funded by selling their own share of UNI tokens in order to compensate developers and governance representatives for contributions to making the dApp better.

Broader Use Cases

Uniswap, currently, transacts billions of dollars in crypto per month. If we look closer into it, we don’t only have the option to swap between crypto and fiat denominated stablecoin, we can swap ETH for BTC, BTC for UNI, etc.

In the future, my guess is that assets like stocks, futures, fund interests, fungible commodities, etc. might be traded on uniswap through AMMs. Why? it is simpler, more accesible, it will become cheaper, it saves money on transaction fees by decreasing the amount of transactions needed to rebalance portfolios and the amount of middlemen involved in transactions, it operates 24/7/365 uninterrupted in a very secure, transparent and efficient way.

Say we want to sell AAPL and buy TLSA, traditional order books require selling AAPL and buying TSLA, AMMs could allow for AAPL to be directly converted into TSLA, positioning for a potential 30% decrease in trade fees.

I see a future where Uniswap is the place where private companies go to make an IPO (or an ICO - initial coin offering) and where auction markets can be created for things like real estate, art, etc. Now, this might seem far away, but Europe already has a very robust regulation allowing for this.

And this is why I believe tokens like ETH have value, because they are fundamentals to the operations of companies like Uniswap which serve millions of customers that pay millions of dollars for their services.

Conclusion

When people hear crypto, they hear “scam”, “bitcoin”, “ponzi”, etc. I hate BTC as much as the next guy, because that is an actual Ponzi, but BTC is not crypto. It is important because it was the first successful attempt at cryptographic digital asset blockchains, but the digital asset space has a lot of potential where value can be created for a better financial system, this is why it has value, not because of people buying Bitcoin at 2,000 and selling at 5,000. Now, this might go sideways for years, but claiming that it's a scam is either malicious or extremely uninformed. It's simply in its early stages and still figuring it out, as the kids would say nowadays.. People hate what they don’t understand, they are unwilling to even try to understand it. This is where opportunities lie a lot of the time, looking at what no-one else understands or wants to look at.