Lately I’ve been having conversations relating to success. Everywhere we see, we hear very successful people talk about how they come “from nothing” and built themselves up to what they are.

Once I heard a guy, who is probably worth USD 200M or 300M at the moment, have an entire conversation about how he “started from the bottom”. He went on to say: “when I started in this business [real estate], my dad only had 4 hotels on the beach”… The layman’s appropriate response to this would be:

Successful is a broad word. Of course, success is something much more complex than money. Achieving healthy relationships, life satisfaction, a higher living standard relative to what you started with, etc. they are all measures of success at different magnitudes and verticals. But, for the purposes of this text, the definition we are going to use is the most mainstream: having achieved popularity, profit, or distinction. Be that in sports, business, academics, etc. Mainly focusing on profit (money) but not neglecting the other two. Especially because distinction and popularity can be monetized; now more than ever.

Being successful in financial terms can also get complicated, and this is something we have to account for. Most people, in most places, do not strive to become Mark Zuckerberg, they have a “regionalized” metric or threshold for success. Idiosyncratic success, if you will.

Some theories that research this particularity include: Social Comparison Theory by Festinger, the SEM comparison model, the Proximity Principle, Contingent Self Esteem, etc. Of course, none of these come without criticism. But, looks like there is evidence that comparing ourselves to peers with physical proximity and intrinsic similarities occupies more mental space than to someone we have never personally met and can’t relate to.

For example:

Kids see the rich and/or popular kid at school as the epitome of social status. Their school is made up of 600 kids, of which 100% don’t even have a high school degree…

The son of a low income African immigrant living in France will feel extremely successful if he can achieve a college degree and a stable job. Spring-boarding him into the middle class, allowing for savings, leisure, etc.

On the other hand, Bill Gates’ son will be surrounded by the highest performing people in every metric. Therefore, his success threshold looks extremely different. His bar to be considered successful is much higher than the previous two people.

Social Media is somewhat changing this. Seeing people with massive amounts of success being relatable, on camera, could expand the comparison proximity radius for everyday people. I don’t want to get too deep into this for the moment, because it is not as relevant, but its definitely something to consider.

Nonetheless, we have to also take into account absolute success in order to determine the elusive recipe to extreme success, the guys at the rightmost of the bell curve. This is where we are going to be look at the Bezos, Buffets and Slims of the world. Yes sir, we are going Malcom Gladwell this time and trying to understand the inputs for the success function:

In this article I will be learning alongside you and, as always, the idea is to understand subjects more in depth without the need for super specialized knowledge or analysis, in order to have a more nuanced perspective of societal and structural phenomena.

Main Predictors + Data on Success

The book this article is named after, Outliers by Malcolm Gladwell, has a thesis establishing (roughly) that: extraordinary success is not solely the result of individual talent or effort but is largely shaped by external factors such as cultural background, timing, and opportunities. He popularizes the "10,000 hour rule," suggesting that mastery in any field requires extensive practice, while also emphasizing the role of hidden or overt advantages like birthdate, socioeconomic status, and access to resources in determining success.

I found a large study by a UCLA professor on the weight of the variables influencing individual financial success. Made by machine learning models, the conclusions are as follows:

In summary: financial success in the U.S. is primarily determined by educational attainment, occupation, and gender, with work experience, working hours, and parental socioeconomic background playing secondary roles… Something smells fishy to me… Below we have some more insight into this study, things about variance, outlier data, etc.

Machine learning is an interesting tool for forecasting or Predictive Inference, which is different from Causal Inference.

As we saw in my article about regression analysis, correlation does not equal causation. Cold temperature is a great predictor of Flu case surges. But, the temperature itself does not cause viral sickness, a virus does. Cold climate just promotes a great environment for the virus to thrive, so it finds its best time to spread.

If we put someone in a cold room but we control the causal variable by sanitizing it, maybe administering antibiotics, the cold temperature no longer has viral infection as a result. On the other hand, we could have someone in a room at 28º C and, if we inject them with Influenza virus, they are extremely likely to contract the disease.

According to academics, Machine learning is not great at causal inference. And what we are trying to find here is causality. As you know, I will find a way to weasel out of giving a hard conclusion, which is what most people want… why? because shit is complicated. Other models like the Mincer Earnings Function, which is also a predictive regression, account for similar variables. In general, predicting is great, but we want to go deeper.

If I was tasked with just predicting how financially successful someone will be, I would use the same variables as the studies im discarding right now, they are my Temperature to your Flu. They work because they often find a mix of part and proxies that have a very strong statistical relationship. Sometimes, predictive variables are also causal, but not always. On the other hand, proxies sometimes have an indirect feedback relationship with the subject at hand, which is why they become proxies in the first place.

Lets go ahead and, more philosophically, or less formally, try to have a discussion about the underlying factors driving this macro indicative variables like education, experience and wage.

Education

Kinder Garden, Primary School, High School, College and maybe some higher level degrees. Education is extremely ubiquitous in our western world, especially in pockets of high income earners.

Ubiquitous is sometimes confused with trivial, and education is not trivial at all. It is obvious that primary education and middle education is fundamental for a well developed human being, but, does it have diminishing returns after high school? The Steve Jobs of the world and other hyper-successful college dropouts and college deniers have fueled the engines of some actors who are intellectually or financially invested on people not going to college.

Lets look at some stats provided by this Forbes Article:

84% of the 400 wealthiest Americans (as of 2017) possessed, at least, a bachelors degree. Take this measurements with a grain of salt as it poses a one time snapshot.

Now a days, only about 40% of the general population over 25 (important age because it adjusts for time to get the degree) has a bachelors degree. A number that has been increasing. Meaning that wealthy 400 have more than twice the higher education rates, at base, than the rest of the population. In the link there is more interesting info about this.

23% of the 400 wealthiest from 2017 went to an Ivy League School.

Comparatively, as far as I can tell, the general population’s share of Ivy league graduates is below 1%, so they are 23X to 50X more likely to come from prestigious universities.

40% of the Forbes 400 hold degrees above bachelors, including MBAs, LLMs, etc.

Compared to a general population’s 13%, give or take, (data 2019). So 3X more prominent in advanced degrees. Advanced degrees are the rich person’s bachelor.

About 10% of the Forbes 400 list are college dropouts, the likes of Zuckerberg and Gates, while about 5% never went to college at all.

People might read this the wrong way. Someone who quits college because the opportunity cost of his time is too high to go to university is not the same as someone who drops out because of some other reason.

Ramsay’s study on Millionaires, not Forbes 400, but all millionaires in America studied the same trend. They got to a similar conclusion regarding education rates. Not necessarily referring to Ivy League schools.

Pew research center talks about the degree vs. no-degree pay gap. College graduates tend to out-earn non-graduates:

Unemployment for graduates is cited to be lower than the general population.

Close to 75% of graduates value their college experience personally, professionally and skill wise.

This might be a form of selection bias. The people who are industrious, professional and capable enough to get through college will apply those skills on the job. This particular point would put college as a proxy rather than a cause.

Education appears again and again when talking about macro indicators of success, is it causal? (not casual)

Probably to some degree (hehe), but that is not the whole story.

There was this show I remember, on Netflix, called Operation Varsity Blues. The documentary was about wealthy parents paying their kid’s way into prestigious Ivy League schools. Why do I say this? Sounds anecdotal and kind of irrelevant in the grand scheme of things, until you look at the following stats:

College graduates with college educated parents can create substantially more wealth on average, than first generation college graduates, citing income of +35% for second generation goers vs. first.

From 2014 to 2019 donor related applicants and legacy applicants were, respectively, 7X and 6X more likely to be admitted to Harvard University than the average person applying.

Legacy applicants are 4X more likely to earn admission into Princeton.

But come on, this are only a handful of students in the actual class, right? Well.

Notre Dames 2022 incoming class was 19% to 25% were legacy students. This is cited as one of the highest rates of legacy enrolment in the US. 25% is really high. Despite legal cases and broad criticism, these practices are likely to stay in place.

Though, in fairness, according to the Ramsay study, only 8% of total US millionaires went to elite schools, and up to 2/3rds went to public universities & state schools. Meaning that you still can create wealth without going to elite Ivy League schools.

Moreover, there is still no proof, in this article, that Ivy League school curriculums actually contribute to wealth creation substantially more than any other college education. Lets think about the mechanisms through which Ivy League schools might become overrepresented in the Forbes 400:

Improving the culture, soft and hard skills of capable students who capitalize on their studies in order to make money through societal value add.

Selecting for students with industriousness, commitment, general intelligence and talent by testing these skills and refining them through a series of challenges in their curriculums.

Just selecting for, and hosting, people with already incredible opportunities (wealthy people’s kids) who go out and act upon them, with an Ivy League badge on their chest. Perpetuating the appearance of success.

Mixing capable people with rich people’s kids in order to put huge capital to work in capable hands in a symbiotic capital-talent relationship.

Mixing rich people’s kids with other rich people’s kids for family collaboration, dealings and competitive advantage exploitation.

Just branding, people might perpetually be impacted by seeing a Harvard logo in a resume, leading to better opportunities → more wealth accumulated on the long term, on average.

We know all of these go on in these schools to some degree. The question is: to what extent? The first option feels like the purest form of value added to society. The last one looks like a strategic choice made by an aggregate group of students who know how this works, fomented by cognitive biases surrounding prestige that society responds to. The third one seems like a compromise between meritocracy and privilege. Second and fourth sound like an oligarchic fantasy for wealth preservation of the rich and oppression of the poor.

There are peripheral studies that give us a hint that the Oligarchic fantasy is more present than we’d like. For example this Forbes article citing NBER, found the following:

People coming from families in the bottom 20% of income distribution have increased their participation in college education from 8% of overall college goers (less than half proportional representation) in the 1920s to about 17% on average. Men in that SES attending as 13% of college population and women are represented to par by composing 20% of the total college going population.

In contrast, for elite private universities, that same low income group representation has stayed steady at 5%. Elite public universities follow that same trend, with some exceptions going to numbers like 10%, which is just a little bit above 1920s representation for general college.

The people coming from the top 20% of families, income wise, are very prominent in this universities, with numbers ranging from 50% to 70% of the college’s students.

This is not clue or evidence of a secret society cabal posing as a university, but it is evidence that the amazing networking experience and prestige that is achieved by going to an Ivy League university is out of reach for most people who are low income. In contrast, it is well within the possibilities by top income families, in some cases, they are overrepresented 3.5X to population, even the medium income families, the 60% in the middle, are underrepresented 0.41X to population.

And I would answer, to myself, yes, but… Education, not necessarily elite education, is still a main driver of wealth and financial success. So, egg on my face? Nope…

What drives a successful education brings us full circle:

Factors contributing to general education success:

One of the main factors, if not the central factor, influencing Academic or Educational success is Socio-economic status (social class) [EPI][NCES].

Another key indicator is higher cognitive performance, or General Intelligence, which is directly linked to better academic achievements.

Non-cognitive factors like motivation and grit, parent involvement, self esteem, home stability, quality of early education etc. are also related to Academic performance. (posible also related to SES.)

Many of the factors for academic success, which appears to translate to financial success, are out of our control. Things like the Socio-Economic status we are born into, parental involvement and quality of early education (which are probably not independent from socio economic status). On the other hand, things like hard work and intelligence, which are proprietary abilities and qualities of the individual, are also key. You can be born smart in a high rise in Manhattan or in a Farm in Alabama.

So meritocracy is not dead yet, not completely, and it may be getting better on some ends. Meritocracy is, though, challenged and very far from perfect. It seems that coming from a wealthy family might pose a substantial advantage regarding education at all levels. This means a much larger margin for error, which is key for success.

Lets look closer into it. These are complex variables as they are not independent from each other, like, at all.

So, lets tread lightly when drawing hard conclusions.

Rich Kid Poor Kid (yes, another book pun)

I have never read the Rich Dad Poor Dad book and don’t really know anything about its content. But here is my version:

Think of an average kid who’s parents are very well off, stable, involved and loving. He has access to things that are deeply important factors of healthy growth: healthy food, good preventive medical care, a decent house in a safe/nice neighborhood, privacy, education, after school activities, socialization, therapy, culture, travel, grows up amongst money talk, is amongst entrepreneurial talk, knows wealthy peers, has parental involvement, experiences financial security, enjoys some luxuries, enjoys some leisure, has a feeling of overall safety, can pay school tutors, SAT tutors, has a car, spends money to go out with friends, can go to summer camp, etc.

All of these allow for a kid to be physically healthy and develop a healthy self esteem. Also, he can understand how money, relationships, hard work and life works, from a very young age. He will have mentorship from parents and people adjacent to them, likely other very well off important and powerful people. His parents will craft opportunities for him, push him to take them and support him through the work of actually capitalizing on them. He will, likely, have a whole family structure raising him, including: parents, grand parents, uncles, aunts and possibly brothers, from where he will be able to access more and more perspectives, people, opportunities, etc. He is also likely to have lots of high achieving people around him, these people can help him develop his ambition and aim for really high standards in whatever he wants to do. Go even further… when he grows up, people might even respect him more, or at least act like it, as a way to cozy up to the opportunities he or his family can provide. The parents will work as a backstop in case some entrepreneurship or job goes wrong, leaving people more confident with the idea of working with him. He has things to lose, people will feel more comfortable trusting him. He will have enough stability and margin for error that he won’t have to resort to antics or rush anything he wants to do, he can afford to wait until things happen the right way, gaining experience through failed endeavors and growing up to, very possibly, be a well rounded human being.

Consider an average kid who is raised by an abusive single mom in the projects who works two jobs to make ends meet and a family structure composed of his mom and the mom’s mom. His neighborhood is really unsafe, he is alone most of the time as mom is working. He has no guidance, he is likely eating really bad (quality or quantity wise), his schooling is probably not the best, no health insurance, no therapy, no afternoon activities. Grows up seeing gang violence, maybe even experiencing it. Has to worry every day about things like: getting home safe, making himself lunch, neglect, child abuse, anxiety about breaking things, spending money, not being able to buy something he wants, etc. His living conditions and lack of guidance make him a below average student. He will likely be pray to a gang that will exploit his lack of resources in order to induce him into working for them; if not, his job opportunities will likely be scarce, because of his educational background. Transportation will be a huge issue for him. He is likely to have to become indebted to a bank or maybe a gang in order to spend on something basic like getting through a tough month with some unexpected expenses. Rent will be really hard to come by, even for a sub-par apartment. He will have to come through and help his mom get through tough times as well. He will be ostracised by the powerful and wealthy, he will be seen as someone who needs to be dishonest to make ends meet, he will not be taken seriously because of how and where he grew up. People will assume he will not amount to much, hence never even give him a chance.

The contrast is very clear in this layout of edge cases. One average kid, maybe even think of the same person, will have a vastly different experience out of life in one case vs. the other. Both have their issues, both have their tricks. Undoubtably, the poor kid has it harder. People do not work optimally when they are hungry, they are not smart as their genetic potential would allow them if they are not well schooled, they can develop anxiety, depression and other kinds of mentally illness. Personality disorders can arise when exposed to extreme situations when young (family violence, death, food insecurity, etc.), extremely limiting their potential to operate in the world. It is really clear to me how the first life is conducive to achievement, respect, stability and the possibility of achieving happiness. The second life will likely end on tragedy.

You guy’s counter argument, which is valid, would be to say that most cases don’t look like either. 90% of the population likely live somewhere in the middle: well off with aloof parents, middle class with great parents, everything is right but a traumatic childhood event happens in childhood by pure chance, etc. Go further, and tell me about how some outstanding individuals can turn the second scenario into becoming a successful 1%er, and there are kids in the first scenario who just can’t figure it out and end up on rehab.

What I would say, in this hypothetical discussion with an audience is: yes but… wealth is not distributed evenly, success is not distributed evenly, all of those nice things everybody wants are concentrated at the top. In life, very few people get high and tangible rewards for trying, people love to cheer and cater for the ones who don’t need it. But we’re digressing into an abstract back and forth, lets see this play out in the numbers.

Gender

Men vs. Women, the current culture war in the US. We know that women have become educated at a much higher rate than men, consistently, through some decades now. If Education is the key predictor of financial success and wealth, it is reasonable to expect to see women outperform men, or start to outperform men, soon.

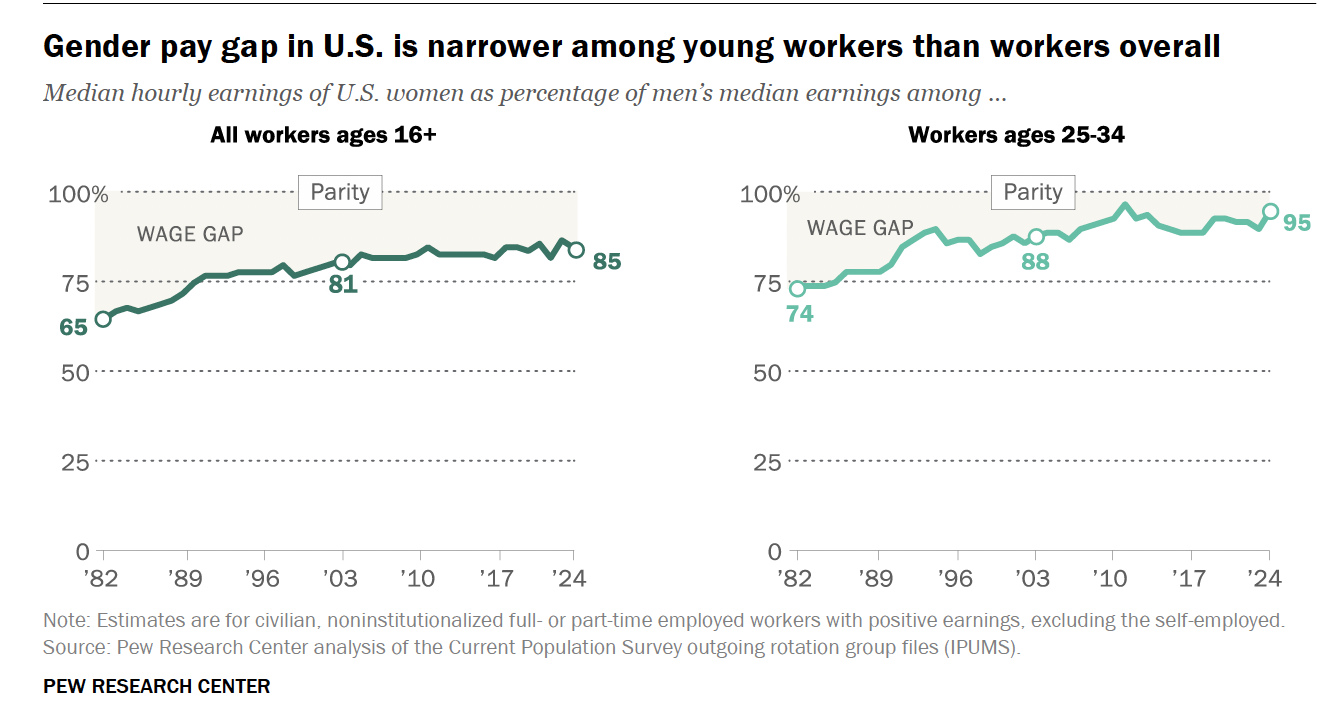

But it is not the case, women, despite now being more educated on average for about 30 years, are still earning around 85%+/- as much as men, only 3% higher than what it was 20 years ago. These states are usually from median wage figures, so outlier effects are likely mitigated.

We can see on the right side of the chart that parity is 95% amongst a very specific age group. The Machine learning model defined gender as a variable independent of education, working hours, parents income, etc. Because this is a controversial topic, it has been studied quite a lot.

General consensus is that, when adjusting for some practical things, the gap narrows. These things include differences in: working hours, assertiveness, career goals, career paths, college degree choice, specialization choice, child bearing, etc. After adjustments to these practical differences, there is still a small gap. Probably attributable to more intangible causes that are harder to adjust in a macro scale. This includes some discrimination, cognitive biases and others. Look at this video for more in-depth info, or this video for a debate.

Only 17% of the Forbes 400 list are women. If you look closer at those 67 or 68 women, a considerable amount are heirs to empires the likes of L’Oreal, Mars, Wallmart, etc. About 90% of Billionaires are men. So, it seems, that it will be an advantage to be a man if you want to become hyper successful. Adding to the successful arc, men have the upper hand in things like C-Suite tenure and high executive roles.

Now, there is a trick here… Thy say money doesn’t buy happiness… Despite earning less women are happier than men, all across the board (pretty much) despite having a harder time creating wealth and income.

Again, these things are complicated, and we could never give enough nuance. So lets move on to a more general subject.

Overall Socio Economic Status(SES) Trend

The Ramsay study states that, out of all US millionaires, 79% did not receive any inheritance, and only 3% received +1M USD inheritance.

In 2011, 32% (60% in the 80s) of the Forbes 400 list came from very wealthy families (assumed large inheritances, or in life money donations). Making the case of large inheritance 10X larger than in the general millionaire population. 48% (20% in the 80s) came from upper-middle class parents and only 20% had little wealth or grew up poor.

69% of the list formed their own main business and about 2/3rds are considered to be high on the “self-made score”

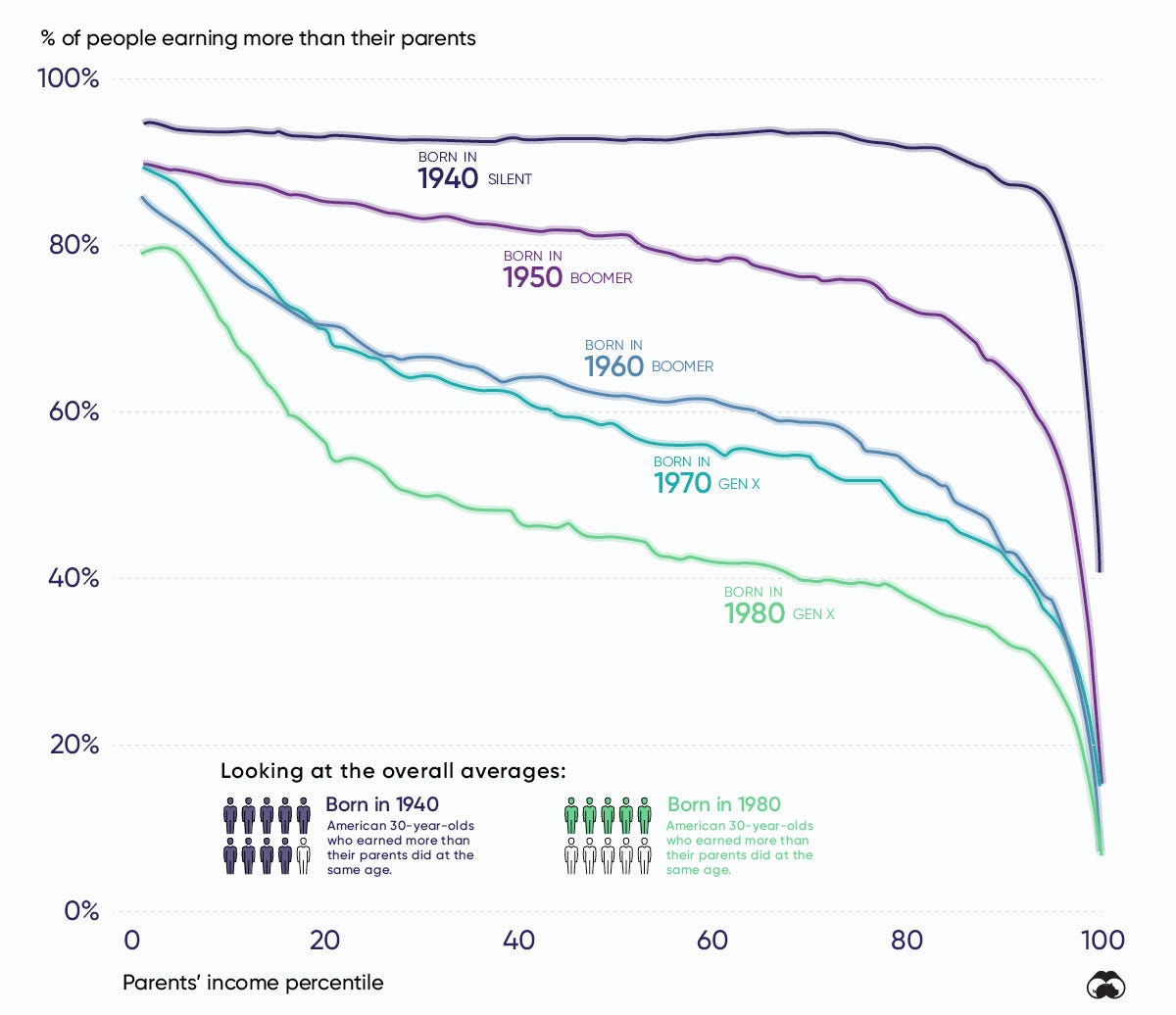

A pattern is starting to form, where intergenerational wealth compounding is the norm, on average. By consequence, on average (again), those who come from a lot of money can compound past wealth into massive fortunes while those who were born into debt, can even fall shorter than their parent’s did as their liabilities grow more than they’re assets. In fact, as we progress, having a better living than your parents did, becomes rarer each decade. Social mobility seems to be harder and harder (there is, for sure some diminishing societal returns involved in this).

On the other hand, the ability to access college financing, pensions, retirement funds, savings accounts, etc. are potentiating the wealth creation abilities for the kids of, mostly lower-middle class families, but also low income, relative to the middle class and above (in share of people out earning their parents).

The power of more accessible education, compound interest and work experience acquired inside a specialized sector, which are proxied by age in the above models, are good predictors of increase in wealth and income. And they are probably good causal factors as well.

Meritocracy, in this article, took a huge beating, but is still standing, tumbling around, with an eye as big as a melon.

It is important to establish -Even though someone might have had a privileged upbringing, it does not mean they are not competent, bright or hard working. People who come from super wealthy parents and go on to become wealthier than them are probably competent. The difference between a 80th percentile performer vs a 95th percentile performer is marginal, given marginally decreasing returns. So, when a wealthy person puts his son, maybe an 80th percentile performer, to lead the company rather than a 95th percentile hired CEO, the profitability hit taken by the company might be compensated by the dad’s trust on the son, dedication and tenure (time in tenure). Nepotism is sometimes the best alternative.

The rabbit holes can always become deeper and deeper, and it is rarely a good idea to go on some internet research rabbit hole for controversial subjects. So that is exactly what we are doing.

Normally Distributed

Gladwell talked about circumstantial factors influencing success, which we already did. I will one-up him in this section. And this might be a bad idea, as this subjects get controversial, but I have never been one to hold back, so here we go…

In the gender section we concluded that men have an edge on success, because of many reasons, but women are still happier, why is that? the short, concise, answer is the classic: money doesn’t buy happiness, but that saying doesen’t quite tell the full story.

Women are happier with more income and/or wealth, but the effect that earning more money has on happiness is much more pronounced in men. It seems to be the case that Men’s life satisfaction is increased in much higher proportion to women when individual income increases (of course accounting for diminishing returns on income). Getting deeper into the subject - both spouses are less happy when the woman’s income is larger than the man’s. Apparently, men are very sensitive to their absolute and relative income status; while women are more concerned about the proper provision of resources to the household (proper is also relative).

The social, personal and psychological rewards of becoming rich are much higher for men than women. When looking at it this way, it makes much more sense that men would break themselves to get ahead, while women won’t as much, because the incentives are there to foster that climate. The higher the prize, the more suiters there will be.

Additionally, men tend to be more assertive, risk taking and aggressive, than women. Amongst other traits. Some of these traits are favorable to financial success or at least increase the variance of outcomes regarding financial success. As we saw above, the difference is marginal for most people, but is is incredible at the extremes.

So taking a 10,000 ft view, we start to see how these dynamics result in extremely different outcomes for the extreme versions of some groups vs others.

I once heard a phrase about warfare, somewhere along the lines of: you might have the will, but you don’t have the means. Regarding financial success men appear to have the will and the means (at least some men), that is why we see such dramatic differences in the tails of the distibution. When we look at individuals things are much more complicated, because small numbers are generally much more random, but these types of structural and behavioral advantages come to play in the background.

There are almost 8 billion people walking around on this earth, which means nature had 8 billion attempts at creating the one Tom Brady, there are 8 billion people but just one Magnus Carlsen, there is just one acting President of the United states. In this world, you need more than will to get ahead, you can have will + talent and it might not be enough. No… in this world, to be the best, you have to have top skills complimenting top discipline and relying on top luck, anything shy of that will not do. And, how nature works, there are very few people that can fill those shoes.

The Normal Distribution tends to explain a lot of the world’s phenomena. Skills, height, g-factor, strength, etc. tend to be normally distributed. In a Normal Distribution you can think of being extreme (best/worst/ biggest/smallest/ etc.) as a “reverse exponential”. There may be 10 people at your gym that can bench 250lbs, up the weight by 50% to 375lbs and the number of people who can bench that wont be 5 (50% decrease), it would probably only be 1 guy, or none.

So, and increase in 50% on weight causes a 90% reduction on the amount of people strong enough to lift it (these are just off the top of my head made up numbers to explain the nature of outliers on normal distributions).

A normal distribution has two defining variables, one is the mean (μ or mu) and the other one is the Variance (σ2). The Variance is the Standard Deviation squared, so a calculator might ask for either. Below’s chart explains it more visually, on the X-axis we are adding or subtracting standard deviations (σ) from the average or mean (μ). To read this we have to understand that, how high the line goes upward in the Y-Axis, is representative of how many datapoints are at that level.

Think about it on weightlifting terms, say that the average person can bench 80lbs (made up for simplicity) and the standard deviation is 15lbs. If we assume Normality, the Normal Distribution tells us:

The amount of people that will be able to lift between 80lbs and 95lbs (0 to 1 standard deviation above the mean) is about 34.1%.

The amount of people that will be able to lift within a 1σ deviation from the mean (going both sides -1σ and +1σ) will be about 68.3%.

The amount of people that will be able to bench press 125lbs or more will be about 0.1%, which is the same share of people who wont be able to lift more than 45lbs.

We know men are physically stronger than women. We can just assume that the σ for the men’s distribution changes to a higher one, say σ=25. This means that the share of people being able to lift 125lbs, or more, increases from 0.1% to 0.36%, meaning a 3.6X increase. Now, making it more realistic, we move up the mean for men to 100lbs with a σ=25 and that share increases to 15.87%, 158.7X higher than the general share.

Small changes in the average and standard deviation make up for insane differences on end results in the extremes (tails). We were able to increase 158.7X times the amount of people who can lift +125lbs by increasing mean by 1.25X and standard deviation by 1.66X. When you hear about fat-tailed or long-tailed distributions, what they mean is that there is more variance of potential outcomes.

Because men have more variability in weight benched and a higher average, most of the people who can bench a lot of weight will be men. In this example, +99% of people who bench that much would be men.

Now that we understand this concept, lets think about what we said we need to be the GOAT. You need top talent, top work ethic, top opportunities, etc. sometimes by themselves, sometimes a combination of multiple. Assuming each of those are independent from each other (for which I have no evidence that they are) we are looking at something so stratospherically low, that is sometimes hard to imagine. dividing 1/8B we get 0.000000000125, those are the odds of being the best in the world at anything (sort of). Independent, for example, means that, having 0.1% strength doesn’t come with 0.1% work ethic. In general, that one event happening does not influence the outcome of the other.

Now that we have laid out the foundations, lets get into it.

Darwinianly Great

With research we are understanding ourselves more and more. As we move forward, science is seemingly looming above the idea Meritocracy like a flock of crows just waiting for the end, philosophically. This because of the, relatively new, concept of Genetic Determinism.

Some weeks ago I watched Destiny’s commentary on a debate between Dr. Mike and Dr. Mike. One Mike has a PHD on Sports Physiology and Dr. Mike is a Physician. Handsome Mike argued for nurture and Bald Mike was on the side of Nature. I really recommend you watch.

Dr. Mike argued that people in the center of the normal distribution for the traits that make people successful might have an environment that is really not conducive for the proper development of those traits, tipping the scale of success to their detriment.

Dr. Mike counters explaining that, with an intergenerational view, because those traits are hereditary, it would make sense that people with low prevalence of those traits create a bad environment for their kids, perpetuating the higher odds of a precarious life.

Outcomes discussed include: obesity, financial success, drug use and some others.

The main traits discussed are general intelligence (g-factor) and conscientiousness. General intelligence is the capability to perform in a variety of different cognitive tasks. Conscientiousness is a part of the OCEAN model for personality traits. Conscientious people are notable for being responsible, diligent, careful and deliberate. These two factors are very heritable, g-factor is 50% and conscientiousness is about 44%. This heritability measures are not directly studied by looking at genes but at test scores in people with genetic similarities (twins, parents, etc.). The measure for heritability comes from a concept analogous to an R² in a regression model referred to as h², look at the article below for more in regressions.

Sub-traits might have more or less heritability, for example, linguistic intelligence might be more or less heritable that quantitative intelligence. There are other factors that influence heritability of many genetic traits like: gender of the kid, age of the parent when having the kid, etc.

We established above the main traits contributing to academic success. Well, lets look at what the studies say about conscientiousness and general intelligence.

Conscientiousness:

Inversely correlated to drug abuse, tobacco use and overall risky behavior.

General Intelligence:

Also positively relates to academic performance, financial success, physical wellbeing, drug use (higher intelligence correlates with higher drug experimentation, not necessarily dissorders) and higher life satisfaction.

These two traits are extremely relevant when accounting for financial success, and they are huge drivers in academic success. They seem to be inherited in great measure.

Importantly, they might not hold completely linear relationships, for example, general intelligence holds more of a parabolic relationship with financial success, according to some of the literature. Sometimes extreme traits get in the way.

If a trait is 50% heritable, h²=0.5, then what goes on with the remaining 50% (1-h²)? Both traits, g-factor and concienciousness, are polygenetic, so there is a lot of margin for variability, both in nature and nurture. 1-h² is where nurture and chance come to play. The factors that account for the rest of the acquired traits are:

Environment: everything external to the child’s genetic construction that might influence the development of the traits. (Eg. Nutrition, child neglect, childhood injury, etc.).

Epigenetic (A more fancy way to talk about environment): some genes or genetic traits can only express themselves under specific environmental conditions.

Developmental Stochasticity (another fancy way to talk about environment): things like womb conditions, birth conditions, etc.

Genetic Randomness: some of the genes and/or genetic combinations that children acquire at conception are extremely random (as far as we know).

We have said that education and intelligence are the highest predictors of financial success. Meritocracy is happy:

But intelligence and education are highly, and directly, linked to socio economic status:

But socio economic status, especially intergenerational, might come from intelligence and/or conscientiousness.

But intelligence and conscientiousness are not developed but genetically acquired, in large part, possibly creating a self-perpetuating cycle of the same family trees oscillating in and out of the top.

But… heritability has some margin for randomness, that might favor some random person? Potentially creating a small share of new family trees with the ability to generate wealth through 2 or 3 generations. Maybe even incredible Forbes 400 wealth. Having some sort of family tree replacement in the rich family tree index fund.

This got way too dark to fast, so Doge comes to provide some chill. We’re in some sort of genetic determinism, nature vs. nurture, stochastically driven chicken or the egg situation.

What do we make of all this?

Chicken Talk

Studies exist on what crafts success on a macro scale. What happens on a micro scale is much more random. I think this article is not about predictive power, but about what the general population would consider fare and just.

The chicken or the egg (now) is a made up paradox, because we’ve known the answer to the question for a while. The species that is the closes direct ancestor preceding, what we know today as a chicken, reproduced. Some sort of genetic mutation happened during that reproductive event, maybe a single one, maybe in multiple cases, that led to the egg resulting from it to have the genetic construction of a modern chicken. After that egg hatched, the first chicken ever was born. So the egg came first, that is a fact.

The success story is much more complex… it involves many sub categories that are super complex on their own (genetics, randomness, macro structures, etc.) and then combine them, which exponentiates the complexity of the system by several orders of magnitude. They are also interdependent on each other, to different degrees, which just sends complexity to the moon.

Bald Dr. Mike is saying something along the lines that: the normal distribution of financial outcomes for people with high conscientiousness and/or general intelligence has a mean μ larger than the mean for the average population. (In my mind, intelligence curve has a higher mean μ and higher standard deviation σ than average and conscientiousness has a higher mean μ but a smaller σ than average).

This is possibly true on the aggregate, people making consistently better choices, even if they are marginal, through their lives and throughout many generations, are likely to improve their standing on the socio economic ladder. It is also true that you cannot take that heuristic as seriously when not making judgements in a macro, or at least somewhat large, scale.

If you are betting on the aggregate financial success of different groups of 200,000 people, for sure look at g-score tests and OCEAN personality trait scores. You will likely be right without a lot of context on the individuals composing the group. If you are betting on if Joe Smith will be successful or not, you definitely want to account for context over g-score and OCEAN scores… who are his parents, what was his upbringing like, where did he go to school, what did he major in, etc.

We can, softly, conclude that most people born in the upper 20% will likely be able to reach their full potential, and most people in the bottom 20% will probably fall very short from it. Some micro group people in the bottom 20% who are outstanding will be able to rise to the top, while a small number might make the jump to the middle 60% and, maybe, will be able to, eventually. get the family name to the Forbes 400 list.

Some troubled people in the upper 20% will fuck up a lot, gamble, use drugs, neglect their kids, etc. and just throw away everything that their ancestors built, maybe even leaving the family tree in the bottom 20%. Some people in the upper 20% will slowly descend to the 60% group. What is funny is that, these two family trees might cross each other’s paths in their way to the top or bottom, more than one time. What happens in the 60% group is not as clear, and has more nuance.

We know the aforementioned factors are important to success, and that was originally the first exploratory level for the article. The real reason we are all here is for the second level of the question: is the world meritocratic? and the answer is… it depends, how do you define merit and how do you define luck.

Conclusion

Tim Dillon once said that life is a big casino, and it truly is. From your genetics, to your environment, to the country you were born in, your parent’s racial profile, your parent’s socio economic status, the year you were born, etc. They are all highly determinant of your future success. And some happen before you are even born. They may even be slowly happening through generations before.

Do we have free will and free range to do as we desire and want? depends on how you look at it. Your genetics, environment, etc. will mostly determine whatever you want, desire, aspire to, etc. So the answer is leaning more and more to probably not, you do not have true free will, because of Genetic+Environmental Determinism.

We do, on the other hand, wake up every day and have this perception that we can change things. This may be an illusion, but it matters, we are better off believing we have some sort of control over what we can do in the future. The belief of agency takes us away from pure nihilism. Nihilists squander away potential through an apathetic self-fulfilling prophecy of not trying. Humans, who have the illusion of control, do things every day trying improve their situation. Fake it till you make it appears to be a fundamental part of human existence, and an evolutionary gift for humanity that leads to progress.