Mixed Signals:

In September the Fed Cut rates by the larger of the two plausible scenarios, the Federal Funds Target Rate lowered 50Bps (0.5%) from 5.5% to 5% in its upper limit.

For the Market this, plus news on company earnings, meant a rally. Overall, people on the side that there will be no US recession appear to have the stick for the moment. Despite this, probability for a recession is not declining, some argue the Fed has overdone it and recession is coming, others argue that that the policy is too loose and that other government bodies are stimulating at the same time.

In the end, Jerome Powell and Co. are not fortunetellers or prophets, they are just people who have to deal with:

Economic data, that is usually lagging in time.

Peoples expectations, often from institutional investors that have, for the most part, the same data available that the Fed and could arbitrage away the effect of the policies.

People’s reactions to their reactions

An unprecedented economic environment with extreme complexities: an election right around the corner, effects still felt in the supply chain from the lockups and from the cash stimulus, several armed conflicts around the world that have affected commodity prices markets to a large and broad extent, mostly regarding Russia-Ukraine but also conflict in the Middle East involving the Suez Canal and, potentially, the Persian gulf. A seemingly insaciable demand for chips that cannot be supplied. As well as a less popular, but still very interesting, realization that market interest rates are not as sensitive to fed funds target rates as they would want, in the short term. And an inflow of capital into the USD jurisdiction that is somewhat easing the terms of trade, helping imports, but on the other side increasing some asset prices.

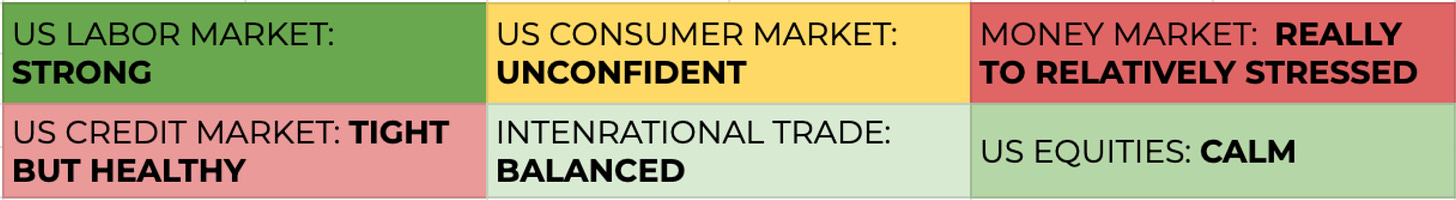

So, will there be a recession? who knows… uncertainty is really really high, which does not seem to be reflected in the markets, VIX seems relatively average and FSI as well. Some say: never bet against the US market, I would say: Do not bet against the Kansas City Chiefs, timing the market in the short term is not a Patrick Mahomes play, that’s more of a Josh Allen-Big Ben play.

Something interesting has been observed recently in betting markets, apparently, Donald Trump has gathered a large margin over Kamala Harris in the presidential race

Also, bets on who gets the house also went to the republicans:

This matters because betting markets tend to be effective at predicting elections.

On other news, there has been a Chinese stocks rally after there were stimulus announced, China keeps doing military exercises threatening Taiwan, North Korea has deployed troops to Russia, things are heating up in the Middle East, even involving US intelligence services in controversies, which could threaten China and California’s ability to procure energy from this region, which are the 2nd and 5th largest economies. Amazon has announced a nuclear energy plan, which is extremely interesting given the ever-growing energy needs and net zero considerations. (interesting videos on nuclear energy from Peter Thiel and the dangers of nuclear proliferation to rouge states and groups and Kyle Hill on misconceptions on nuclear energy safety)

Overall, the US economy is extremely likely to remain hegemonic for quite a while, whether there is a recession or not, whether a recession is catastrophic or not, whether this recession will be reflected in financial markets appropriately, who knows… value is still out there to be accumulated for long term investing.