In the last month was really active for the US Political and Economic system. Donald Trump won the election, by a landslide, and Interest rates were reduced. Following this, all kinds of pieces started getting into motion…

Election:

Donald Trump won the election, by a landslide. From this, all kinds of pieces started getting into motion.

Now, politics is something that we find very tricky. It is extremely complex given that we are dealing with: leader’s emotions, complex legal structures, complex international structures, idiosyncrasies, conspiracy theories, secrets, corruption, disinformation, etc. But some political commentators that we rely on for some guidance on the topic are Peter Zeihan:

A more varied opinion (right to left) on the election can be found here. Lonerbox and Steven Bonnell (AKA Destiny), although controversial and unorthodox, are good alternative media sources:

Polymarket ended up being a precise prediction metric for the election. Republicans won the popular vote for the first time in a while. After that, apparently, the FBI raided Polymarket’s founder house. All kinds of conspiracy theories, the reality is that we know very little at the moment and Polymarket was operating under a legal gray area, especially concerning the access of US Citizens to the platform. In general, we advise going into Ground News when looking for news on polarizing events as a way to mitigate confirmation bias and dis/mis-information.

Markets:

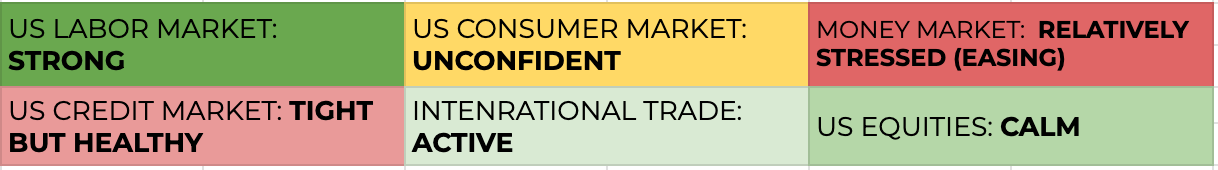

Markets seem to like Trump. additionally, the FED decided to cut rates by an extra 25 basis points in November. So markets have been recording all time highs all across the board in the US.

The yield curve keeps un-inverting:

Jobless claims are lower than expected for the period, meaning that demand will be less dampened, which sends signals to the market, from the FED, of lesser percieved recession risk, which was an unexpected positive outcome for the markets. On the other hand, unemployed people are taking longer to find jobs but it does not appear to be an issue for the fed at the moment, their minutes are not very telling. But, in general, it seems they feel less concerned with long term inflation target and how the market perceives their commitment to low inflation, and have started to look at unemployment a bit more, which has been increasing, as expected, but remains low at about 4.1%. Overall, the FED wants to, at least, be less constrictive in policy.

Money supply has been steadily increasing in the last 12 months, but it has not yet reached peak levels seen in 2022. Stimulating demand.

Deficit spending has been easing as well, but it is still high, also stimulative.

Asylum seeking population, that also increases demand, is in the up as well:

Foreign investment, also an inflationary pressure, is still a bit higher than average. On the other hand, USD dominance (appreciation of USD), because the US is a net importer (imports are 30% larger than exports), is anti-inflationary (different than deflationary, less strong). Especially considering a very aggressive change in USD/MXN from where the US gets 12% of its imported goods, which accounts for a 1.8% impact in total US GDP. US companies can now purchase more foreign goods with the same amount of money. (more goods + same money = better prices)

In general, government policy seems to be stimulative across the board, which worries some, as core inflation remains high, something especially concerning to many Americans is housing, which does not seem to be easing.

Although markets seem to like where things are going, caution should be warranted, especially considering tariffs are inflationary and geo-political tensions are constantly escalating in several strategic spots across the world.